Introduction

Determining appropriate pay increases can be a complex task, involving multiple factors such as employee performance, experience, and industry benchmarks.

In this blog post, we will explore several methodologies that companies can use to model pay increases that are both equitable and within budget. We will cover topics such as promotions, merit increases, merit matrices, compa-ratios, and equity grants. We’ll also provide practical guidance on how to implement these models effectively.

Getting Started

Once we know how we want new hires to come on board, the question becomes, how do I give merit and promotion increases?

The answer is in your compensation philosophy and MRPs. If you need help defining this please refer to our in-depth guide on how to build pay bands here.

Here again, there’s 1000x ways to do this, but we’ll explain a few best practices.

Promotions

The goal of a promotion is to move one person from their current position’s level and pay, to the next level to recognize the increase in responsibility and scope. It’s almost an internal “new hire.”

So to calculate their increase usually you:

- Move them from their current pay to their new role’s range low

- If this is <7%, usually would recommend giving them more

- A “standard” promotion is 10-15%

- Increase equity by giving a grant that is the delta of their current role’s midpoint/MRP to their new role’s MRP

- You could look at their total grants to calculate, but that puts them at a disadvantage — they EARNED that previous equity, so why penalize for it?

This then will get you a good estimate for their increase, which you can allow your managers to increase / decrease (within guidelines) as they see fit if you have manager discretion.

Merit Increase

Merit is trickier. Some companies will give their employees a 3% increase each year, and allow managers to increase / decrease with discretion. The best practice that I use is a merit matrix.

This matrix is driven by a comparison ratio or “compa-ratio”. This is just the current salary divided by the range midpoint.

Why is a compa-ratio this useful? Because this is the target that we said we expect most employees to be paid at. So if every employee had a “1.0” compa-ratio, we can tell if they are being paid at their market rate, regardless of what value their MRP is.

So using this principle, I know I want to move my employees who are meeting expectations towards the midpoint; those who are not meeting expectations I don’t want to move much or at all; and if they are exceeding, I want to move them above and even towards the next level pay.

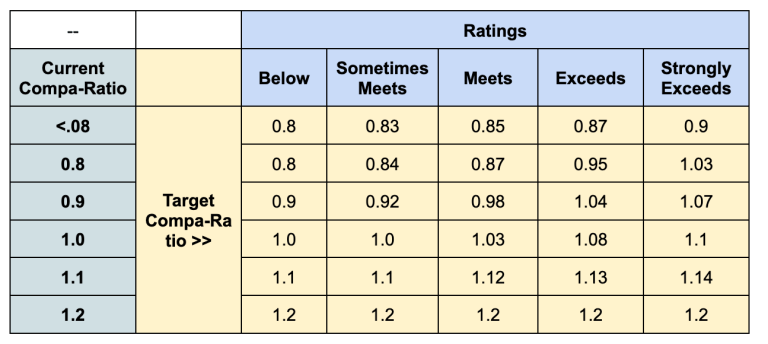

So how do I do this systematically? Enter the compa-ratio matrix. It looks something like this:

The key things to note are:

- Below expectations get nothing unless they are below range low.

- Strongly exceeds expectations gets the largest planned amounts

- Individuals who are paid closer to the range minimum get larger increases than those near the range max.

- Anyone at the range max, get nothing

This matrix is wonderful, because it corrects issues with negotiations and other biases over time. For example:

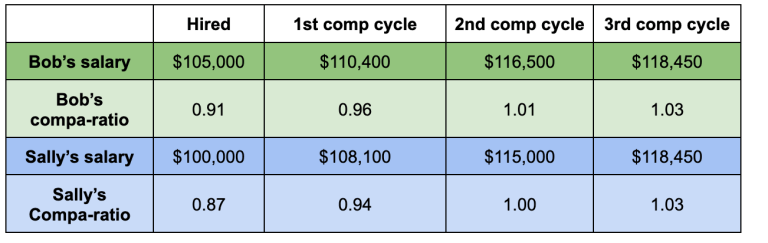

We have Bob & Sally. Both interviewed for the same role and level, but Bob had 1 year of more experience so he got 5k more than Sally. Now they are in the company performing the same work, against the same expectations — and are getting the exact same performance ratings. Let’s see what happens over time with a compa-ratio matrix:

Assume a midpoint of 115k. They get a “meets expectations” each cycle.

NOTICE: Sally’s increases are LARGER than Bob’s each cycle, until they catch up to the MRP. This is intentional, because she is paid further from the MRP than Bob, but they are performing the same. Also, depending on how you configure your matrix, you can catch them up in pay after 1 cycle or 2 cycles — you just adjust the planned target compa-ratio in the matrix. In this example, we made a cycle program that caught them up in 3 cycles.

This is why I like compa-ratio matrices. When I’m dealing with an organization of thousands, it’s too hard to try and balance where everyone should be paid — so instead, I use a matrix to calculate.

Pro tip: Now if you want your matrix to run really well, you should smooth your ranges so that the range minimum is equal to 0.8 (so multiply your midpoint by 0.8 which is 20% below (roughly) and then multiply the top end to 1.2 or 20% above roughly. This creates a clean floor and ceiling that is easy to flag and identify.

Other Considerations For Compensation Cycles: The Power of Pequity’s Calculated Fields

There are other things you need to consider when creating a cycle. Things Pequity can help with is flagging specific scenarios such as:

- When someone has gone >12 months without an increase

- If someone has had an increase in the past 6 months

- Someone with 2 or more Exceeds ratings but no promotion

- Someone who has not been promoted in >2 years (below a certain level)

- When someone’s pay leapfrogs their manager

- When someone is almost fully vested in their equity

- When someone was modeled an increase, then the manager took it away (if discretion applied)

- When someone was NOT modeled for an increase then the manager added to it

- If someone was promoted and doesn’t have an increase given / or manager took away

- If someone was a “Below” expectations and receiving an increase / manager applied budget

- If someone is >5% above peers

- If someone is >5% below peers

NONE OF THESE EXIST in current merit systems, besides Pequity’s and it’s a huge pain point to manually create. It’s also what managers care about, because it helps prevent squeaky wheels from always getting the increase over others who deserve it.

Refresh Equity Grants

In a cycle a company may offer “refresh” or “evergreen” grants. These are grants meant to keep an employee’s equity vest whole over 4 years. The most typical process is to grant equity that is 25% of the new hire target, that vests over 4 years equally. If you do this each year, then at year 4 the employee’s equity will be equal to 1 year of their target (0.25 x 4 = 1.0) so it’s a way to keep them at their market target rate.

There are OTHER ways to vest though. For instance, you can grant 25% of their new hire grant, and just vest it all in year 5. This is called a “Box car”. This keeps them whole, though they have to wait until year 5 to see the equity and there is no waterfall effect (where equity compounds in on itself).

Refresh is generally done annually, or around the employee’s start date. To make a process out of it, the company will usually create a cycle for refresh either quarterly, biannually or annually. It’s a lot of work so they try to capture as many employees each cycle as possible.

Conclusion

In conclusion, implementing equitable pay increases is crucial for ensuring employee satisfaction and retention. Companies can achieve this by using methodologies such as promotions, merit increases, merit matrices, compa ratios, and equity grants. By using these tools effectively, companies can ensure that their employees are being paid fairly and within budget. The compa ratio matrix is a particularly useful tool, as it corrects issues with negotiations and biases over time, ensuring that all employees are paid based on their performance and proximity to the midpoint of their salary range. Ultimately, by prioritizing equity and fairness in pay increases, companies can attract and retain top talent, while also fostering a positive workplace culture.

Overall, modeling all of this can be a timely process, especially in spreadsheets or outdated HR software. If you are seeking to automate the process of providing fair pay increases on a larger scale, you may be interested in exploring our compensation cycle tool (promo and merit tool), which is designed to handle the entire process for you.