So you’ve been tasked with creating a compensation program that can attract and retain top talent. Or maybe you’re just curious if your existing program is on track, and you want some guidance.

A compensation program, by our definition, is the end-to-end lifecycle of compensation outcomes that an employee will experience at your company. This includes everything from their offer to future merit increases, to even their severance or termination agreements.

Each of these is due its own series, but we’ll provide some of the detailed steps on how to build your program from start to finish.

Want Pequity to create a competitive and comprehensive compensation management program for your team?

Step 1: Gather data from your HRIS and ATS

When doing a compensation program build or analysis, data from your HR Information System (HRIS) and Applicant Tracking System (ATS) will be your best friend.

If you don’t have those, you should create a repository of the individual’s pay and add details as you go.

At a minimum you should pull as many of the following details as possible:

- Employee Census: employee email or Unique ID, start date, job level, title, role, location, base pay rate, base pay currency, bonus target/amount, equity granted, equity outstanding/not vested, spot/sign-on bonus amount, spot/sign-on bonus pay dates, relocation bonus amount, last comp change date, last comp date reason, and any other compensation inclusion (stipend, car allowance, etc) amount, and termination date.

- Candidate offer report: unique ID, offer date, role, level, location, base salary offered, the bonus offered, equity offered, relocation offered, sign-on offered, offer outcome (accept/decline), candidate current company, and candidate competing compensation.

- Existing pay documents: pay philosophy, offer letter details, bonus details, and equity vesting details.

Once you have all these elements collected and organized, you’re going to move through the remaining steps. A great place to organize and centralize this data is in a platform like Pequity, where you can maintain clean compensation data separate from your HRIS and ATS.

Step 2: Document your current compensation practices

Do you have levels?

How does your company decide what to pay new hires versus existing employees?

When someone is promoted, does it always have a compensation change?

Even if you do not have a formal process yet, you need to assess what is happening today and write it down. The major transaction questions you need to be able to answer to move forward are:

- How do you determine new hire offer amounts?

- How do you level your employees when they are hired or promoted?

- What types of pay do employees receive? (Salary, bonus, equity, etc)

- Who is involved in decisions today? Do managers have any discretion?

- How often does the company update pay ranges if at all?

- What data sources does your company rely on to create pay?

- How are budgets set? Who sees budgets and who is involved in creating them?

Write down the answers to all the above; you’ll use it in the future for change management and to prioritize what you need to do first. If you don’t have any documentation, Pequity has a pay philosophy template you can use to compare to.

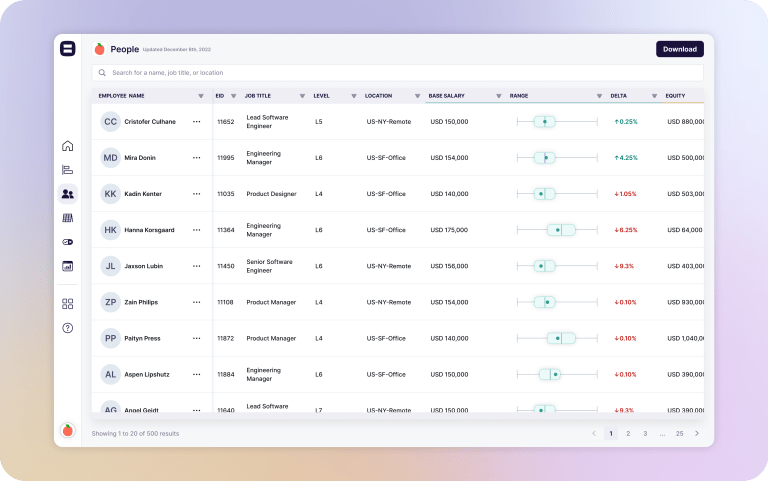

Step 3: Assess the people data you gathered from your ATS and HRIS

Now that you have all your data collected, and information on what’s happening, it’s time to evaluate your data from your ATS and HRIS.

Here are questions you should gather from your data:

- For each combination of role, level, and location, what is your median pay for all pay elements?

- What is the pay range for all pay elements for each role, level, and location?

- How many people are below their range minimum or paying greater than 5% from their peers?

- What is the median pay for employees (based on role/level/location) hired in the last 6 months?

- What is the median pay for employees (based on role/level/location) with 6+ months of tenure?

- What is the median pay mix for each role/level/location (e.g. what percent of total compensation is base pay vs equity or bonus)?

- For top-line leaders, are there significant pay differences?

- If employees have a pay/bonus target, what % of that target were they paid last year?

- How many promotions did you process last year?

- How many new hire offers were accepted last year?

- What was your top talent source and talent competitor?

- What is your average and median tenure?

Added bonus if you include gender, ethnicity, or performance ratings in the medians above!

You can gather many more, but the above will start to paint a picture of what is happening at your organization. The reason you do so many comparisons is you need to answer the following questions:

- Are my employees in similar roles being paid similar rates?

- Are we being consistent across roles/levels/locations in our pay practices?

- Do we see our pay program as health? Do we have a positive acceptance rate and a strong promotion trajectory?

- Do we see “hot spots” or glaring issues with any particular team or role in the company?

Step 4: Determine how your talent goals support company goals

Now that you can visually see what is happening in the company, and you know how it happens, it’s time to start incorporating your leaders.

Talent is one of the largest costs for an organization. It’s also one of the largest assets. However, if you are not viewing your compensation as a competitive lever, you could be wasting dollars.

So this is where you should be meeting with key talent stakeholders. If you’re a small company, this can start and end with your CEO. For larger companies, you should talk to:

- Head/VP of HR

- Head/VP of Talent

- Head/VP of Engineering

- Head/VP of Sales

You need to ask each of these stakeholders these questions:

- Who do you want to hire talent from and why?

- What are your organization’s key metrics?

- How do you hold employees in your org accountable to these metrics?

- Have you heard rumbling about pay? If so, what have you heard?

- What are your top talent concerns this year?

- How much will your organization grow this year?

From this, you can start to identify what the organization needs from the employees.

Is your engineering organization doubling in size? You will likely need more middle managers, so you better check your levels are aligned.

Is the sales team confused by their bonus plan calculations? You may need to create a calculator for them.

Is the company aiming to hire talent from a competitor but not succeeding in poaching them? Might be time to do an in-depth analysis.

Additionally, you can determine if you need to build a pay-for-performance plan that aligns compensation to performance over time.

Step 5: Get salary survey data

This is where we need to find a good market data source.

A rule of thumb is that free data is often the lowest quality data. A good salary survey will thoroughly analyze and anonymize their data, share how old their current survey’s data is, and have clarity around where their data comes from and how it’s prepared.

In addition, you can always negotiate prices. Typical surveys range from $7,500-$25,000, but depending on the number or size of cuts you buy it can be more or less.

When purchasing a salary survey, we recommend you message multiple of them armed with a list of your top talent competitors or the companies your leaders would like to hire from. You can ask each survey if these companies participate in their survey, and if they do, you can ask to do a custom cut of data just from these talent competitors. You often have to request a minimum of 10 companies to pull a custom cut, but it’s good to get a quote on this more precise survey.

Now getting a custom cut sounds good, but it has its drawbacks. On one side you get data specifically from the talent you care about, but you will always get less data because there are fewer companies participating.

However, if you have the budget, purchasing at least one custom cut and an industry-wide survey will provide you both a larger market sentiment as well as a laser-focused view of what your desired talent is paid.

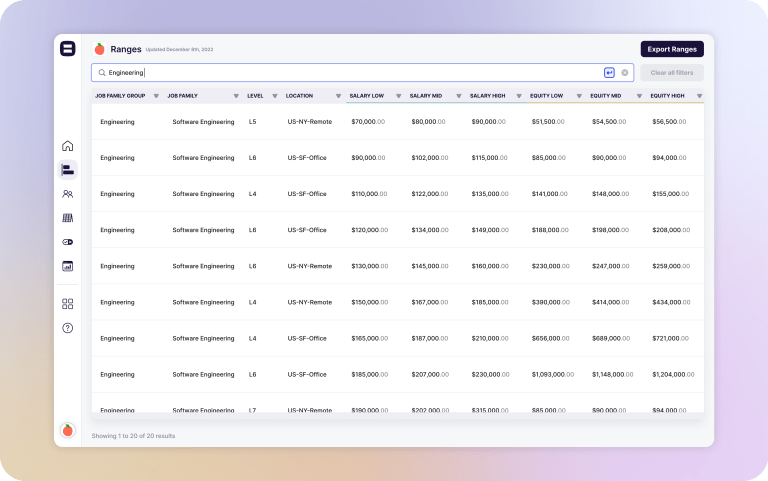

Step 6: Benchmark salaries and compare your employees to your market data

When we say “benchmark” this means that you take all of your roles/levels/locations and you assess how it compares to the survey.

Some companies will do an “individual benchmark” – this can be useful if you already have a pay system and are looking to deepen your data on a particular type of work. Still, usually, this will create more complexity than it’s worth. Benchmarking across roles/levels/locations will give you a more centralized view of how varied pay is across similar work.

Once you benchmark your employees, you need to compare each pay element to the market survey and determine which percentile is closest to the pay rate. This can be onerous depending on your analytics skill, but tools like Pequity can do this automatically for you.

Once you know what you are paying for each role/level/location and pay element, write this down. If you are paying P75 and are losing talent, it may be a sign you need better education for employees and recruiters. If you pay P25, you may need to increase your rate.

Step 7: Draft your compensation philosophy

This is where you start to make suggestions for changes.

Now that you know what people are paid, how it compares to the market, how well it’s working for the organization, and what your leadership’s talent goals are — you need to ask, what type of program would support the company best?

For a thorough compensation philosophy, Pequity provides a template, but you can also draft your own by answering the following:

- Do we pay at, below, or above the market average for total compensation?

- What pay elements will we offer to which employees as a standard?

- How often will we compare our pay to the market as a whole?

- When and how could an employee’s pay be increased?

- How does performance factor into pay?

- What are the levels at the company and how are they determined?

- What is the company’s stance on pay transparency? How much do you share?

- When a new hire offer is made, do they get the same as employees? How do we control that?

- How are merit increases determined and who is involved?

- How and when are promotions determined and who is involved?

- For equity, how often will refreshes (if at all) be given and when?

- Who is involved in setting budgets and pay decisions?

This is just a short list, but once you have the answers, you’re going to go back to your documents on what is happening today and compare your proposal. Highlight where there are large changes, and if you are suggesting any pay increases, calculate the approximate impact of this on both existing employees and future headcount budgets.

Pulling it all together

This is just a short guide to what any compensation practitioner would be doing – and if you don’t know where to start, this is a good list to begin with!

Once your pay philosophy is set, you generally move on to creating ranges, training, and processing pay adjustments as needed. If you have a platform like Pequity that can simplify all of this for you, you should be able to wrap this up in 6 weeks. Without a platform like Pequity, you should anticipate 4-6 months to do yourself, or for a consultant to complete on your behalf.